Last year I wrote a post that included a video that offered a fun way to remember how debits and credits work. I’ll do my good deed for the day by not including the video on this post, but if you want to see it, here is the link to that old post.

After I showed the video to my class last year, a student wrote to me to share a mnemonic she had learned from her high school accounting teacher that she thought also made remembering debits and credits a bit easier.

I’m a big fan of mnemonics, but somehow, despite having taught accounting for just about 40 years at this point, I had never heard of this one.

The mnemonic is DEALER, and here is how it works.

The image below represents what is known as T-account, a way to visualize any account that a company keeps track of, such as Cash, Inventory, Equipment, Accounts Payable, Revenues, and Expenses. There would be separate T-accounts for each account a company uses. The line down the middle is designed to separate the left side (the debit side of the account) from the right side (the credit side of the account).

For any given transaction, at least one account will be debited and one account will be credited, and total debits must equal total credits for each transaction.

What the mnemonic refers to is how to increase the various types of accounts. To record an increase in a Dividend, Expense, or Asset account, you would debit the account. To record an increase in a Liability, Equity, or Revenue account, you would credit the account. When you need to decrease an account, you would do the opposite, e.g., to record a decrease in an Asset account, you would credit the account.

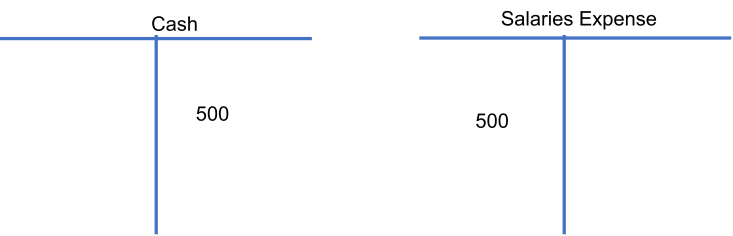

Here is an example of what it would look like to record a transaction using T-accounts. Let’s assume the transaction is for recording the payment of $500 in Salaries Expense.

As noted above every transaction affects at least two accounts; in this case, the two accounts are Cash and Salaries Expense. Cash is an Asset while Salaries Expense is an Expense. Using the guidelines above, since Cash is an Asset, and it is decreasing, we would credit the Cash account. Since Salaries Expense is an Expense, and it is increasing, we would debit the Salaries Expense account.

Here is what it would look like:

So there you have it, a handy mnemonic to remember how to record transactions using the Debit/Credit framework of Accounting.

Once the student shared it with me, I have used it every time I have taught the material since then. In fact, tomorrow is the big day for me to reveal the DEALER mnemonic in my Intro to Accounting class.

I just hope the students are as enamored of it as I am…

Fantastic mnemonic device. Also, I am glad I don’t have any need for it any more 🙂

LikeLiked by 1 person

I think it’s helpful, and it is even better if you don’t need it! 🙂

LikeLiked by 2 people

Me, too!

LikeLiked by 2 people

poor accounting, no respect 🙂

LikeLike

I am glad you didn’t include the video again. LOL!

I see you wanted me to 😶🤚 once more before tbe day is over. But I do hope your students are enamored with it. For me to be enamored by something math related would have to be something amazing!

LikeLiked by 2 people

I’m glad I got a head smack out of you; I guess if you had watched the video it may have been double head smack kind of day. It was hard to tell if the students were enamored 🙂

LikeLike

I thought you would be happy.

Hard to know what they were thinking with their eyes closed, eh?

LikeLiked by 1 person

masks on and eyes closed; I have no idea what they are thinking 🙂

LikeLike

It may be best that way. LOL!

LikeLiked by 1 person

yes. it’s better than having them yell out how awful class is…

LikeLiked by 1 person

I’m so glad I have an accounting package that does all of this for me. And an accountant to do my annual returns. Good luck with your class and hope they live this mnemonic.

LikeLiked by 1 person

it’s always nice when there is someone to do the stuff you don’t like. And I hope my students found it helpful…

LikeLiked by 1 person

Uhg! I feel like I just had an accounting lesson.😄 That is a clever way to remember how to set up T accounts. Any expectations about how the students will react? Tell them it will be on the test.

LikeLiked by 1 person

sorry to ruin your day 🙂

I guess I’ll find out tomorrow if they found it helpful – first quiz of the semester…

LikeLike

We used mnemonics in 2nd grade when I taught, though not for debits and credits.🤣 Never Eat Soggy Worms comes in handy when teaching seven-year-olds directions.

LikeLiked by 1 person

I like that NEWS one; I’ve got to start thinking about more mnemonics that are geared towards seven-year olds – they are probably more memorable!

LikeLiked by 1 person

very cool and we are always learning from our students, I learn from my pre-k kids on a regular basis. I love the worms one Pete and this is new to me, now it all makes sense!

LikeLiked by 1 person

the worm one from Pete is a great one. I mentioned to him that I am going to have to think of some mnemonics that are geared towards 7-year olds. they would probably be quite memorable…

LikeLiked by 1 person

i know you can do it, jim! you are so good at these

LikeLiked by 1 person

I am good at thinking and acting like a seven-year-old…

LikeLiked by 1 person

Our memories are a fascinating thing. Most often all we need is a gentle nudge in the right direction, and we are much more capable with our recall. Mnemonics provides the jumping off point. Good to know that learning never ends!

LikeLiked by 1 person

good way to put it; any little nudge will help. I hope the students find it useful…

LikeLiked by 1 person

I love mnemonic devices.

I also love that I was a writing major in college.

LikeLiked by 1 person

sometimes I wish I had been a writing major!

LikeLiked by 1 person

I can never remember if it’s spelled nmemonic or mnemonic. There must be some sort of trick available to help out with that.

LikeLiked by 1 person

when I saw your comment, I was worried that I misspelled it every time. I think the trick that helped me was the spell-checker…

LikeLiked by 1 person

Hmm, I’ll try to remember that spell-checker trick.

LikeLiked by 1 person

but then you’ll need some sort of reminder for that…

LikeLiked by 1 person

Okay. I’ll try a nmemonic.

LikeLiked by 1 person

there you go, problem solved…

LikeLiked by 1 person

After 20 some years of accounting on a daily basis, I’ve finally reached a sort of zen-reflexive ability to account without error. Every now and then (like right now with a bunch of year end accounting adjustments) I’ll stumble when using an obscure balance sheet account. Luckily, I’m using quickbooks and no adjusting entries are required. I just go in and alter the botched entry. Perhaps DEALER will help.

LikeLiked by 1 person

I am sure you’ve learned lots of tricks of the trade over those 20 years that are now just second nature to you. and QuickBooks can be quite helpful, but I think it’s good to know what’s going on behind the scenes as well…

LikeLike

Guess the old dog isn’t that old after all.

LikeLiked by 2 people

somedays I feel older than other days… 🙂

LikeLiked by 1 person

Don’t we all.

LikeLiked by 1 person

I guess we do…

LikeLiked by 1 person

I love that we always learn something new reading your posts! 🙂 hehe even if it’s accounting! 😛

This is a bit embarrassing but I always have to stop and think about the difference between accounts payable and accounts receivable lol… that’s where I’m at LOL

LikeLiked by 1 person

I hope the post didn’t put you to sleep 🙂

and as far as AR vs AP, I’d much rather have an AR…

LikeLiked by 1 person

It’s funny how, when you work with this all the time, you just know and it becomes so easy. It’s hard to remember it every not being easy.

LikeLiked by 1 person

well said. and I try to remind my students of that all the time. if they don’t understand what I am talking about, they need to ask a question. because to me, it’s perfectly clear 🙂

LikeLike